October 2025 Newsletter

View the PDF version of our October 2025 newsletter: WMCU October 2025

Holiday Closings

West Michigan Credit Union offices will be closed the following dates:

- Monday, October 13

- Saturday, October 18

- Tuesday, November 11

- Thursday, November 27

- Friday, November 28 @ 12pm

- Wednesday, December 24 @ 12pm

- Thursday, December 25

- Wednesday, December 31 @ 12pm

- Thursday, January 1

Access your account through:

- It’s Me 247 Online Banking

- Debit Card

- Shared Branch

- Mobile App with Remote Deposit & Card Controls

Upcoming Holiday Happenings

Be on the lookout for our upcoming Winter promotions. Beginning on November 1, 2025, we will begin our Annual Holiday Loan Special with a new competitive rate to jump start your seasonal shopping!

You can expect our Skip-A-Pay program to return this December to help you keep some wiggle room in your budget and start making new Holiday memories.

We will be collecting new, unwrapped toys for our local youth beginning November 1, 2025 for Angel Tree, Toys for Tots, and Project Christmas. Visit your local WMCU branch to donate and support your community.

This limited time offer begins November 1, 2025.

Stay up to date on our limited-time offers by following us on Facebook and Instagram and by visiting WestMichiganCU.com!

eStatements

Don't forget to enroll for eStatements to receive your statements even faster!

To sign up for eStatements, login to Online Banking and find eStatements under Popular Features on the left hand side.

2026 Board of Directors

We have incumbent board positions up for re-election for our 2026 WMCU Board of Directors. If you are interested in volunteering to be a board member, please send a letter of intent and resume of qualifications to the Nominating Committee by December 15, 2025.

Send all submissions to:

WMCU

Attn: Lori Malpass

1319 Front Ave. NW

Grand Rapids, MI 49504

Note: There will be no nominations from the floor on the day of the event. Voting will be held at our Annual Meeting scheduled in March 2026.

New Tiers for Money Market Accounts

Savings yields are now higher than they have been in some time. If you want to keep your funds accessible while earning an above market rate in a safe investment, consider a WMCU Money Market Account.

View new tiers and rates for a Money Market Account here!

Rates effective October 1, 2025.

Community News

Bloom Credit Union

At Bloom, we’ve always focused on helping members & the environment thrive! As part of our partnership with the Arbor Day Foundation, for every new account opened since January 2024, we’ve been planting a tree in a forest of great need in Michigan. So far, we’ve planted 10,914 trees!

Learn more about Bloom CU's community involvement.

West Michigan Credit Union

At West Michigan, we partner with Giving Tree Books to promote children’s literacy and provide new, free books to children from under- resourced communities. We plan to donate books to 5 schools near each branch, and we’ve donated over 1,000 books so far in 2025!

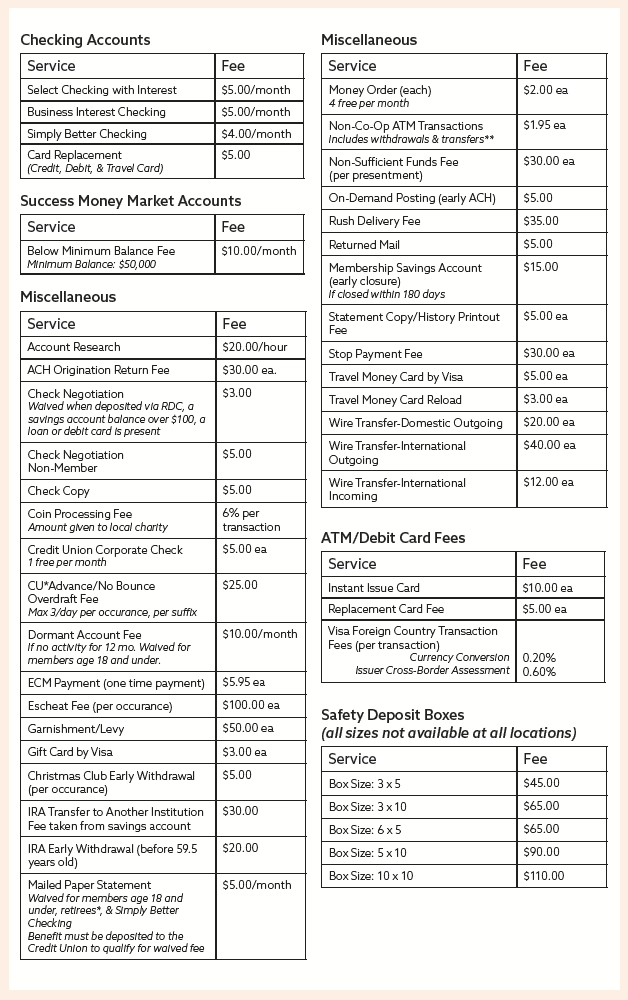

Fee Schedule

Effective January 1, 2026.

Please be assured there are no new or increased fees.

*Retired members are members who receive a retirement annuity, pension, Social Security, or similar retirement payment from private government sources, or live in or belong to a retirement organization.

**Fees may be charged by owners of Non-Co-op Network ATMs; however, 30,000 surcharge-free Co-op Network ATMs are available with no fees charged by the ATM owner.

Fees are subject to change. Ask any Credit union employee for details.

Communications

Working together as the most trusted resource to help our members' financial lives be simply better.