Say Goodbye to Debt: Best Strategies for Financial Success

Published November 25, 2024

It is no secret that debt causes stress. But did you know that financial stress can be a gateway to accumulating more debt? With 77 percent of American households living in debt, it can become a never-ending cycle. Changing your spending habits and selecting a strategy for paying off debt can alleviate financial stress.

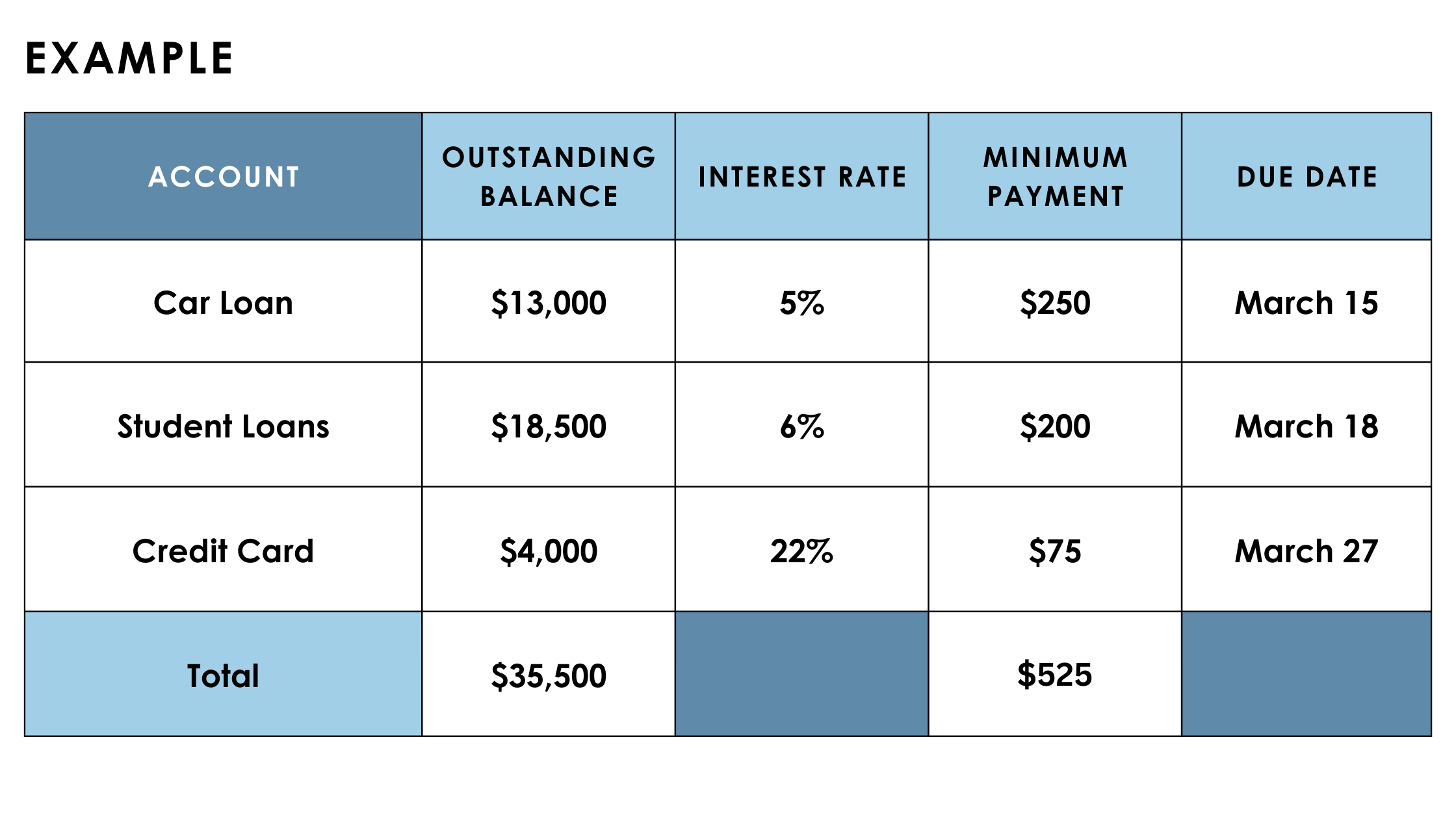

The first step to starting the journey to becoming debt free is to write down all your debt:

- Outstanding balance

- Interest rate

- Minimum payment

- Due date

Include debt from credit cards, student loans, mortgages, cars, personal loans, and any additional accounts. Setting up a chart will help you visualize how your debt is broken down and guide you to choose a repayment strategy that works for you.

Looking at your minimum payment balance, set a budget for how much discretionary income you can contribute monthly. Contributing even an extra $100 towards your debt monthly can speed up how quickly you can achieve a debt free life. It is imperative to not add additional debt to your accumulated outstanding balance and to create an everyday budget that can accommodate your goal of becoming debt free.

Debt Snowball

The most common method of eliminating debt has been coined the “debt snowball”. The strategy works by starting with the lowest balance. In the example above, the debt snowball would target the credit card debt first because it has the lowest balance of the three accounts.

Continue to pay the minimum balance on the remaining accounts and use your budgeted discretionary income to target the lowest balance. If you have $200 extra to put towards paying off your debt, use the $200 on the lowest balance. In this case, your credit card monthly payment would be $275 instead of the $75 minimum payment.

Contributing the same amount monthly will chip away at the overall outstanding balance. After reaching the goal of $0 in the first account, use the discretionary income used for the lowest balance towards the next lowest balance. If you have additional accounts to pay off, repeat the debt snowball strategy until you are left with a $0 balance.

Pros of the Debt Snowball Method

- Highly motivating: Watching the balance of one account dwindle overtime can be extremely motivating and can keep you on track.

- Achieve a $0 balance on one account quicker: With your discretionary income being spent on one account, you can reach your goal of $0 sooner by starting with the lowest balance.

Cons of the Debt Snowball Method

- Accumulates more interest: Compared to alternative methods, the debt snowball method will not save you the most money because interest will continue to accumulate on loans you pay the minimum on.

- Can take longer to repay all debt: While focusing on one account at a time, repayment can be more time consuming and as debts with higher interest rates compound, it will expand the balance you owe.

Debt Avalanche

Similarly to the debt snowball method, the debt avalanche strategy follows the same process of focusing on one account at a time while paying the minimum balance on the other accounts. However, instead of starting with the lowest balance, you will start with the highest interest rate.

In the example chart above, the highest interest rate is the credit card debt at 22%. Follow the same procedure as the debt snowball strategy by allocating discretionary income from your budget to the minimum payment of the account with the highest interest rate. Once the account is paid for in full, begin contributing the previous payment to the account with the next highest interest rate. Continue this process until all debt is paid.

Pros of the Debt Avalanche Method

- Saves money: Targeting higher interest rates first will ultimately diminish the amount of interest paid overtime.

- Decrease debt faster: Paying off accounts with higher interest first will decrease the amount of compounded interest and allow you to reach your financial goal quicker than alternative methods.

Cons of the Debt Avalanche Method

- Can be discouraging: The account with the highest interest rate may have the highest balance. If it is, chipping away at the highest balance first can lead to feelings of unproductivity.

Which Debt Repayment Strategy is Right for You?

The decision of choosing between the debt snowball or avalanche methods comes down to your financial wellness and goals. If you are someone that enjoys checking things off a to-do list, the debt snowball strategy might be for you. However, if you do not mind waiting to check off your first $0 account balance and are looking to save money overtime, the debt avalanche method might be a better fit.

Alternatively, other repayment ideas include debt consolidation and balance transfers. Debt consolidation involves taking out a loan with a lower interest rate to pay off debt with high interest rates. Home Equity Line of Credit (HELOC) loans allow you to borrow money against the equity of your home and can be utilized for debt consolidation. Balance transfers move credit card debt from one account to another, specifically one with a lower interest rate. To reduce your credit card debt, select a credit card with a lower interest rate.

Stay Accountable & Celebrate Milestones

Debt is not always bad. Loans utilized to improve a financial situation such as gaining an education, owning a home, or starting a business can add positive value to your financial life. Taking out loans and using a credit card regularly can raise your credit score by establishing credit history. Making regular payments by the due date helps build credit, making it easier to obtain lower interest rates on loans needed for future financial purchases.

However, carrying a large amount of debt can be overwhelming… but you are not alone! The average American in debt has a balance of $96,371. The first step in your journey to becoming debt free is choosing a repayment strategy best suited for your budget, financial style, and goals.

Stay accountable by following a budget regularly, making payments on time, and checking progress frequently. Set milestones in your journey and reward yourself for reaching targets. It is not easy to overcome debt, but it is possible if you stay committed to your financial plan and celebrate little victories along the way.

Communications

Working together as the most trusted resource to help our members' financial lives be simply better.